Ensuring rare earth mining doesn’t cost the earth

Rare earth metals or rare earth elements (REEs) are among the most important commodities to the clean energy transition, yet most consumers have probably never heard of them.

However, REEs are one of the clearest examples of the tension at the heart of the world’s net zero commitments. They are essential to the development of green technology, particularly as magnets in wind turbines and electric vehicles (EVs), but they’re also challenging and environmentally damaging to mine.

As these obscure minerals have grown in importance, they’ve also opened a new geopolitical front and created significant supply-chain risk. China currently controls the vast majority of production capacity, and other developed nations are desperate to catch up.

As demand accelerates rapidly for these critical materials, the challenge is twofold: ensuring their extraction and utilisation doesn’t come at an unsustainable cost and navigating the intricate maze of global supply chains fraught with geopolitics and concerns about energy security.

In terms of relative size, the market for REEs is insignificant compared to other global commodities (it was approximately $9.5 billion in 2022), but that doesn’t reflect their outsized importance: enabling much of the technology that powers the modern world, not just in terms of decarbonisation, but also a range of defence applications and almost all digital technology, from smartphones to laptops.

As world leaders gather in Dubai for COP28 this week, global trade in clean energy commodities, including rare earth metals, will be on the agenda with the first ‘Trade Day’ at a UN climate conference. The sustainability and security of the world’s rare earth supply has never been so important.

That’s why we wanted to use this latest edition of ‘The Commodity Perspective’ to explore the challenge of sustainably mining rare earths, the future of a more diverse supply chain, and whether we can reduce our reliance on these metals as the clean energy transition progresses.

What are rare earth metals?

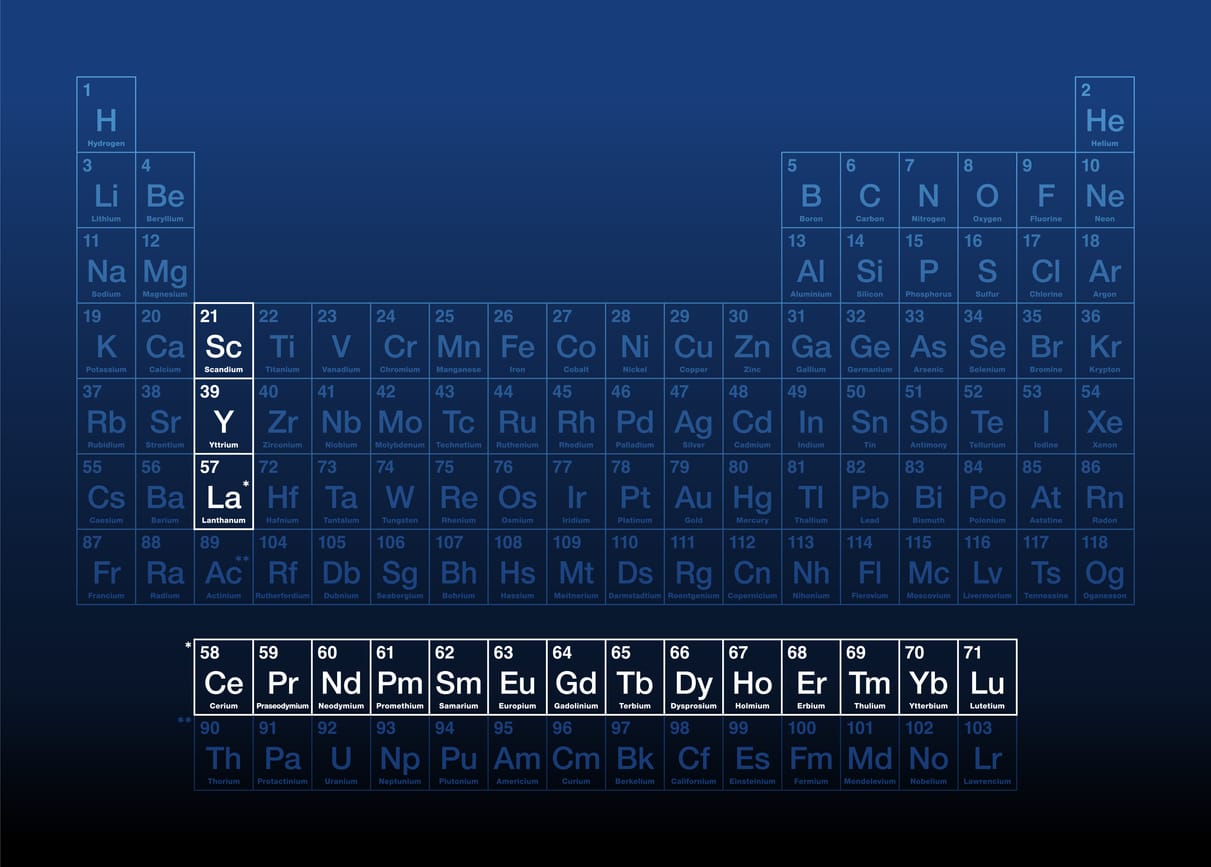

Rare earths are a group of 17 metallic elements on the periodic table.

Fifteen of these elements are members of a group called lanthanides; the other two elements, scandium and yttrium, are located elsewhere on the periodic table but share similar chemical properties. They can be separated into two categories:

- Light REEs – including lanthanum (La), cerium (Ce), praseodymium (Pr) and neodymium (Nd)

- Heavy REEs – the suite of lanthanides ranging from samarium (Sm) to lutetium (Lu) and yttrium (Y).

Some rare earth metals have unusual magnetic, luminescent, and electrical properties that make them valuable for industrial applications and use in manufacturing, and that’s why, gradually, over the last several decades, rare earths have become vitally important to a wide range of modern technologies.

Lanthanum, for example, is used in large quantities in rechargeable hybrid car batteries and as a petroleum-cracking catalyst. Other REEs, including yttrium and terbium, are crucial for some military equipment, including lasers, radars and spy satellites.

Neodymium has magnetic properties that allow it to produce extremely powerful magnets, now commonly found in computers and smartphones, but also, more importantly, as a crucial component in EVs and wind turbines.

How rare are they?

The irony is that rare earth metals are not particularly rare and reasonably abundant in nature. The challenge is finding them in enough concentration to mine.

Rare earth deposits have been found on every continent, as well as the ocean floor, but unlike minerals such as copper and gold, which develop in rich deposits that are easily mined, rare earth metals tend to be more dispersed and rarely found in significant enough concentrations to make extraction and processing economically viable. They’re seldom found in their pure form and are usually within other minerals, making them costly to extract.

China, Vietnam, Brazil and Myanmar have the highest rare earth reserves, with China dominating mining (70% of global production according to the U.S. Geological Survey) and processing (85%).

The irony is that rare earth metals are not particularly rare and reasonably abundant in nature. The challenge is finding them in enough concentration to mine.

Beijing’s control of the market has made it almost impossible for other countries, such as the United States, the EU, Canada, and Australia, to build their own supply chains and operate competitively. China’s monopoly gives them an economy of scale that’s extremely challenging for the rest of the world to compete with. It’s been effective at keeping the price of REEs in the ‘goldilocks’ zone where the Chinese rare earth industry can earn a return, but it’s too low to make it economical for anyone in the rest of the world to build capacity.

REEs are also not traded on a public exchange like many other commodities, and there’s limited price information available. Instead, most REE trading occurs through direct sales between producers and end-users or over-the-counter (OTC), which limits liquidity, especially as demand grows.

In such a Chinese-centralised market, this lack of liquidity risks a repeat of the big price spikes we saw in 2010 when China restricted exports to Japan over a territorial dispute.

The opaque nature of the market makes it a real challenge for traders to manage risk effectively. It invalidates price signals vital for balancing supply and demand, critical in a market crucial to the clean energy transition. There are clear challenges to making REE trading more accessible, including regulation, a relative lack of demand and a centralised supply chain. However, now as we see more countries making a concerted effort to catch up to China (non-Chinese production of rare earths increased nearly four-fold to 90,000 tonnes from 2015 to 2022, according to US data), we would also urge policymakers and regulators to look at ways to standardise REE trading and create greater transparency in the market.

How are rare earths mined?

When rare earths are found in a cluster big enough to make mining economical, historically, that’s involved mining one of three minerals that contain high proportions of the rare earth elements: monazite, bastnaesite, and ion-absorption clay (IAC) deposits.

Mining the more abundant light REEs typically involves traditional hard-rock mining techniques. This can include open-pit mining, where miners remove layers of soil and rock to access the ore. In some cases, particularly in China, light REEs are extracted from IAC through a process that involves leaching the ore with a solution (usually ammonium sulfate) to extract the elements.

Most heavy REE mining (approx. 80%) is undertaken in China and adjacent Myanmar uses the same ammonium sulfate leaching technique. The REEs are then processed, separated and refined to produce the individual elements.

The sustainability challenge

The challenge for the clean energy transition is that the mining and processing rare earth metals generates large volumes of toxic and radioactive material.

EU researchers have estimated that for every ton of rare earth produced, the mining process yields 13kg of dust, 9,600-12,000 cubic meters of waste gas, 75 cubic meters of wastewater, and one ton of naturally occurring radioactive residue.

We can see the implications of this contamination firsthand at the largest REE mine in the world, Bayan Obo, in Inner Mongolia, China. The mine has been producing rare earth metals since 1957, but in that time, the mining activity has also created a vast tailing pond of toxic waste material and more than 70,000 tons of radioactive thorium, which is a natural by-product of extracting REEs from monazite and bastnaesite.

In 2016, Chinese researchers found evidence of radioactive contamination around the tailing pond 35 times greater than soil from surrounding areas. There have also been indications that the tailing pond has been seeping into groundwater and could eventually reach the nearby Yellow River, a key source of local drinking water.

There are now efforts by the Chinese authorities to shut down illegal rare earth mining operations and clean up contaminated areas, but the scale of the environmental damage is such that there have been estimates that it could take up to 100 years before these local areas can recover.

As with many other metals and minerals crucial for the clean energy transition, there is currently a significant trade-off to be made between decarbonisation and the potential for significant ecological damage to areas surrounding these mines. The transition to net zero can’t mean replacing a reliance on fossil fuels with a dependence on raw materials, which leaves large tracts of the Earth uninhabitable.

That’s why exploring whether there’s a cleaner and more sustainable route for rare earth mining is essential.

Can REEs be mined sustainably?

The short answer is yes, or at least more sustainably than current practices.

In the past, the Chinese rare earth mining industry has been criticised for a lax approach to environmental regulations, and authorities have also struggled to control illegal and small-scale mining operations. That is now changing with new regulations designed to improve oversight and reduce ecological damage. However, that’s probably too late for the remaining inhabitants of towns and villages around the Bayan Obo Mining District.

As some of the recently announced government support, led by the US, EU and Australia, begins to filter down the REE supply chain, we should see the benefits of this increased diversity. This should help pressure mining companies to explore more sustainable options as manufacturers, investors, and consumers gain greater awareness of the challenges involved in rare earth mining.

These countries just need to ensure they balance the environmental regulation and sustainability levels on the one hand and the urgent need to mine more REEs on the other.

One recent example of this tension for policymakers and miners is the discovery of Europe’s largest rare earth deposit in Sweden earlier this year. The Swedish mining company LKAB estimates it could exceed one million tonnes of REE oxides. However, the company has also warned that the current permitting process means it could be 10-15 years before they begin mining, and that’s in an area with a long-established iron-ore mine.

It clearly signals the need for governments and the industry to work closer together and offer pragmatic solutions without increasing the environmental risk.

New technology

Beyond regulation, there’s also some important innovations to improve the sustainability of rare earth mining and some efforts from manufacturers, most notably Tesla, to reduce their reliance on REEs altogether.

Chinese scientists have been investigating the possibility of using ‘electrokinetic’ mining – passing an electric current through the REE deposit, which amplifies the effectiveness of the leaching process, significantly reducing the need for polluting chemicals.

Bioming and Agromining have also been proposed as possible sustainable alternatives to conventional RRE mining. Biomining is most commonly used in copper and gold production and involves using bacteria in the processing phase to isolate rare earths. Agromining is an even greener solution which requires plants to be grown on REE-rich soil, after which they are harvested and refined to capture the rare earth from the resulting biomass.

All these practices have the potential to offer more sustainable solutions, but they are nowhere near being commercially viable. That’s why we also need to ramp up investment in rare earth recycling, which may be the approach that can make the greatest sustainability impact in the shortest time. The challenge is that rare earths are not very recyclable. Scientists are making progress using microbes and other solutions, like copper salt, to extract REEs from old laptops, smartphones and magnets, but recycling capacity is still only scratching the surface of the volume of rare earths we need to meet increasing demand.

In many ways, The rare earth dilemma represents the wider challenges facing a decarbonising world. The contradiction means we need to weigh up long-term clean energy goals with the difficulty of short-term ecological impact. We need green technology and alternatives to fossil fuels, but there’s currently an environmental price to be paid if rare earths continue to play their part. Policymakers and the industry must be transparent about that trade-off and seek to minimise it at every turn. The need for these metals is undeniable, but there also must be the imperative to ensure that they don’t, in a very literal sense, cost the Earth.