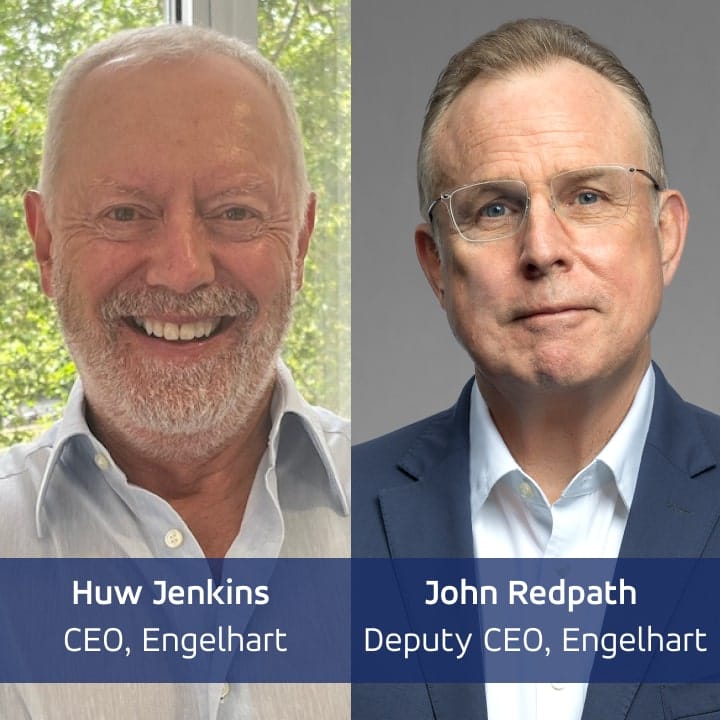

Interview with Engelhart’s CEO, Huw Jenkins and Deputy CEO, John Redpath

To mark Engelhart’s successful acquisition of Trailstone Group, we sat down with Huw Jenkins, Engelhart’s CEO, and John Redpath, formerly CEO of Trailstone Group and now Engelhart’s Deputy CEO, to discuss the acquisition, the integration of the two businesses, and the huge growth opportunity presented by the clean energy transition.

Tell us more about Engelhart’s acquisition of Trailstone. How did it come about?

H.J.: Engelhart has been interested in renewables and expanding our power trading business for some time. Our strategy has been to invest in and grow our quantitative analytics capability, improve our understanding of ‘big data’, and enhance our weather forecasting. We wanted to build a digital model of the world as good as any physical model. Nowhere is that strategy more applicable than to power markets with an increasing reliance on renewable energy. Given the importance of data and the need for financing to support new developers of power assets, we already saw it as an exciting part of the market. Engelhart has been looking for opportunities to be more involved in the clean energy transition.

We could either do that organically and spend a long time building out our trading capability or look to make an acquisition. The latter option brought us to Trailstone Group.

With the support of BTG Pactual (Engelhart is owned by the same partner group that also controls BTG Pactual, the largest investment bank in Latin America), Engelhart had the capital to make this sort of long-term strategic acquisition. We also learned more about the work that the Trailstone team was leading, particularly in the renewables space, and I could see that it was a very attractive proposition.

Engelhart has been looking for opportunities to be more involved in the clean energy transition

J.R.: From our perspective at Trailstone Group, we always knew that we would have to recapitalize the company around this time. Our equity sponsor was Riverstone Holdings, and their private equity fund had a clear lifespan. We knew we would need to recapitalize between 2023 and 2025, so we started the process about 18 months ago.

What was important to us was that we wanted to move towards a permanent capital solution. It gives us much more stability, the capability to offer longer-term solutions for more of our renewables clients and opens up additional trading opportunities in the market. The great thing about the deal with Engelhart is that we get the permanent capital, but we also see the two businesses as complementary.

What was important to us was that we wanted to move towards a permanent capital solution

Huw and the team wanted to expand further into power and gas, and while we primarily focus on power and gas, we also have a renewables business and physical capabilities. We also have a history as a wider commodity merchant and plenty of experience in other markets, including financial oil, agriculture and metals.

H.J.: It’s important to highlight how many synergies this deal creates. Engelhart understood Trailstone’s business in a way that many potentially interested parties may not have, particularly the bigger integrated energy firms who may have been put off by the volatility inherent in some of their activities.

The nature of Engelhart’s business means we like volatility and can see the potential positive diversification effects. For example, we trade U.S. Financial Transmission Rights, and Trailstone undertakes real-time electricity trading in physical markets, which are highly complementary. Engelhart trades longer-term power contracts in Europe; Trailstone focuses on trading intra-day to two weeks ahead.

It’s important to highlight how many synergies this deal creates.

Engelhart provides Trailstone with financial stability in terms of access to liquidity. Trailstone provides us with short-term trading capabilities and a renewables business with an extensive client base in Europe and the United States and tremendous growth potential. I could see that it was a great fit immediately.

John, can you tell us about the history of Trailstone and the development of the business?

J.R.: We founded Trailstone Group in 2013 with five founding partners — of which I was one. We came out of Deutsche Bank, where we had built the bank’s commodities trading business. By 2012, it was apparent to us that the type of commodity merchant business that we had created inside Deutsche Bank was no longer an appropriate business for a European bank.

Initially, we tried to replicate what we had built at Deutsche, but that was a real challenge considering our much-reduced balance sheet. Our original vision for Trailstone was as a commodity merchant, and we traded right across the commodities complex, from energy to metals and agriculture. We owned physical assets and traded in financial markets.

At the end of 2016, we realised that our approach wasn’t sustainable—our cost base was exceeding our revenue opportunity. I took over as CEO around that time, and we decided to restructure the business around energy, specifically focusing on our renewable power business.

Trailstone was one of the first commodity trading companies to see the potential of renewable power?

J.R.: We were. When we started Trailstone Group, we were one of only a couple of organisations managing intermittency for renewable energy assets. It felt like we were voices in the wilderness for the first few years of our renewables business!

We saw this problem early and understood the challenges for asset owners and electricity grids and the opportunity for traders. We talked about this for ten years, and people ignored us, saying, “What are you guys talking about?” The standard view was that renewables were so small they would never account for a price move in the electricity grid.

H.J.: What’s becoming apparent is that the intermittency problem is a massive opportunity for the combined business. You can generate a great deal of electricity without carbon, but you can’t always generate it when you want it. John and his team understood the implications of that before anyone, but now the market is catching up, and there’s some consolidation happening.

We’re seeing global integrated energy firms looking to acquire renewables traders’ technology, talent and customer base. I believe Engelhart’s independence gives the new combined business a distinctive value proposition in the market. Our business is not competing with renewables providers in the energy market; we’re just looking to provide risk management for clients and grow the client-facing business. It gives Engelhart a positive story to tell new and existing customers.

We’re strong believers that for the energy transition to succeed, we need to be able to provide consumers with reliable and affordable energy

J.R.: I totally agree with that. It’s also worth mentioning that Trailstone’s primary customer franchise is in renewables, but we also have a physical gas business in North America, which now has real growth potential as part of Engelhart. We’re strong believers that for the energy transition to succeed, we need to be able to provide consumers with reliable and affordable energy, and natural gas is currently an important part of that.

H.J.: What’s great about the physical gas side of the business is that there are additional natural synergies. For example, Trailstone is one of the few businesses with a U.S. export license to Mexico, where BTG Pactual already has some strong relationships. That would allow Engelhart to become more of an industrial player in the Mexican gas market, which would be an exciting proposition. We can also use that knowledge and expertise to grow the gas business in the U.S.

What is the vision for the new combined business?

J.R.: We have a clear vision of what our organisation will look like in the coming decade. It will be a business with advanced skills in data, analytics, and weather modelling, and it will probably look closer to a technology company than a traditional commodities business. We will be at the forefront of the energy transition, managing distributed assets, clean energy, redundancy, and gas using our advanced digital capabilities. I like to say that we’re building the “commodity merchant of the future”.

I am proud of what we’ve created at Trailstone over the last ten years, not because it was easy but because it was hard. That makes me even more positive and excited about the future as we move forward as one business.

We’re building the “commodity merchant of the future”

H.J.: John’s idea of the “commodity merchant of the future” is compelling, and it doesn’t just apply to the power markets. It’s relevant to all the commodities markets we trade. We will undoubtedly have this growing renewables business. Still, our whole business approach to technology and data will also support the diversification we get from having Ags, freight, oil and metals on the platform. I see that diversification as being fundamental. We will now have this captive flow from our customers, but you need to know how to optimise that flow. Otherwise, it’s going to cost you money. That is why there’s real merit in having that diversification.

H.J.: Engelhart is a “people business” first, and I know that John and the Trailstone team have the same view. Integrating our businesses is a massive opportunity for our people and any talent who might be reading this with interest. Engelhart and Trailstone have many brilliant, creative, and entrepreneurial people, and we see much growth potential in working together. What’s great is that we can create something larger than the sum of our parts. I look at the complementary nature of all the skills across both businesses and see how much we can all learn from each other. People who are good at dealing with customers bring a different perspective on what’s happening in the market, which complements traders’ more analytical views. We will now have more ways to utilise and share our technology and R&D skills.

Engelhart is a people business first

J.R.: I share that sentiment. The merger will create a very exciting proposition for our people and allow us to attract even more talent. Our culture has always been at the core of our business, aligning with our purpose and understanding the difference we’re making in the clean energy transition. It has allowed us to innovate and build the technology that supports our customers, and I know that our shared culture with Engelhart will help us make the merger successful over the months and years to come.

From a personal perspective, I’ve been in the energy markets for 35 years, and I think the most interesting years of my career are ahead as we build this combined business.

H.J.: This is the start of an exciting new chapter for our combined business. By integrating Engelhart’s advanced quantitative modelling and weather forecasting capabilities with Trailstone’s strong presence in the renewable power and gas markets, we create a powerful force for growing our trading activities across the commodities complex. What is clear is that the shift from hydrocarbons to renewable energy is inevitable and transformative; this acquisition means that our business will be at the forefront of that transition.

You can read more about the acquisition and watch a video from Huw Jenkins and John Redpath by following the link here.